Big Opportunity In Little China: An Overview Of China’s Growing Aftermarket

The revenue for the 2015 auto parts manufacturing industry is expected to total $567.0 billion, up 9.7 percent from 2014, according to market research by IBISWorld. The company’s reports also stated that China’s domestic demand totals to $563.8 billion, up 9.6 percent from 2014, and the country’s exports and imports are $32.4 billion and $29.2 billion.

To put it bluntly, China is huge, complex and diverse. And, when it comes to transportation, the country seems to be evolving at the speed of light. New car sales have exploded in China in recent years, having surpassed U.S. numbers and holding court as the world’s largest vehicle market since 2009.

Many of the current developments in the auto parts manufacturing industry in China are being driven by the rapid growth in the number of vehicles on the road in China today. The number of automobiles manufactured in China increased at a rate of 15.1 percent over seven years from 2007 to 2014, in 2014 having 23.5 million units. As of the end of 2014, the total car parc was nearly 154 million, according to Dr. Neil Wang, global partner and managing director, Frost & Sullivan Greater China. Research reports indicate this number is expected continue to rapidly increase in the coming years.

Many of the current developments in the auto parts manufacturing industry in China are being driven by the rapid growth in the number of vehicles on the road in China today. The number of automobiles manufactured in China increased at a rate of 15.1 percent over seven years from 2007 to 2014, in 2014 having 23.5 million units. As of the end of 2014, the total car parc was nearly 154 million, according to Dr. Neil Wang, global partner and managing director, Frost & Sullivan Greater China. Research reports indicate this number is expected continue to rapidly increase in the coming years.

The revenue for the 2015 auto parts manufacturing industry is expected to total $567.0 billion, up 9.7 percent from 2014, according to market research by IBISWorld. The company’s reports also stated that China’s domestic demand totals to $563.8 billion, up 9.6 percent from 2014, and the country’s exports and imports are $32.4 billion and $29.2 billion. The average annualized rate of increase for the next five years in industry revenue is forecasted to be 7.5 percent, which means that, by 2020, the revenue market is projected to be worth $814.2 billion.

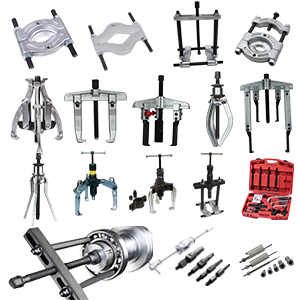

From this industry revenue projection for 2015, 52 percent is made up of mechanical parts and accessories. The second-largest segment is electric motor parts and accessories, making up 24.5 percent, followed by the electronic parts and accessories at 23.5 percent.

As a newer expanding market, many of Chinese cars are also younger. In research done by Technomic Asia from the Auto Care Association’s 2016 Fact Book, it is noted that the average age of cars in China was under five years, with an almost equal amount of cars that are between one and three years old (46 percent) and four to nine years old (47 percent). When looking at the total estimate of vehicles in the light passenger car parc in China in 2014 of 106.3 million market units, 29 percent of the models were Chinese, 27 percent were European, 19 percent were Japanese and 13 percent were American-made.

As a newer expanding market, many of Chinese cars are also younger. In research done by Technomic Asia from the Auto Care Association’s 2016 Fact Book, it is noted that the average age of cars in China was under five years, with an almost equal amount of cars that are between one and three years old (46 percent) and four to nine years old (47 percent). When looking at the total estimate of vehicles in the light passenger car parc in China in 2014 of 106.3 million market units, 29 percent of the models were Chinese, 27 percent were European, 19 percent were Japanese and 13 percent were American-made.

Currently, competition between companies try to get their foot in the door is high and more and more companies are trying to get involved in the market. The largest point of contention is product price, according to IBISWorld, as manufacturers have been forced to partly absorb increased production costs due to rising steel prices in recent years. Other noted driving points of competition is the product quality, service, sales distribution channels, technical expertise of employees and facilities and customer relationships.

The highest barriers for entry based on the their significance are industry competition and industry assistance. As noted earlier, the competition between current and incoming companies is fierce, while China’s market is highly protected by the government and the country often makes it difficult to obtain import qualifications, even for high-quality parts and accessories. While the industry concentration is considered a low factor due to the number of competitive companies in the market, medium factors are capital intensity, current technology changes and regulation and policies within China.

The highest barriers for entry based on the their significance are industry competition and industry assistance. As noted earlier, the competition between current and incoming companies is fierce, while China’s market is highly protected by the government and the country often makes it difficult to obtain import qualifications, even for high-quality parts and accessories. While the industry concentration is considered a low factor due to the number of competitive companies in the market, medium factors are capital intensity, current technology changes and regulation and policies within China.

Looking beyond the barriers to entry, Frost & Sullivan’s Dr. Wang noted what he believes could be four four keys to success for companies looking to enter China. His projections extend through the year 2021.

“Firstly, the cost of auto parts will be lower due to anti-monopoly action against auto parts,” Wang said, “and also service quality will be greatly improved on basis of the government’s effort of promoting and upgrading the automotive repair industry transformation.

“Secondly, more automakers will have their own auto after-sales service company like SAIC’s Achezhan. Thirdly, more and more dealer groups will have developed their own service brands to provide diverse service and products to drivers through different channel forms such as traditional 4S [Sale, Sparepart, Service, Survey] shops, auto supermarkets, etc. Last but not the least, more independently owned stores will provide more convenient, cheaper and better customized service for target segments based on internet business models and O2O service.”